It takes careful calculations to determine whether you can survive with fewer financial resources.

Becoming a parent is a wondrous thing. Balancing home and work can be less wondrous – a parental juggling act of being present for the family and earning a living.

To have more time for children, one parent occasionally scales back work. In my case, I’d had a career and waited to have a baby, so I wanted to be home with my newborn. In Los Angeles, where childcare costs are exorbitant, it also made financial sense. For someone else, it’s the desire to start a business or the consequence of separation or divorce that prompts the paring.

The decision is rarely easy, often involving downsizing. If there are two parents, one might have to maintain a full-time job for the paycheck and benefits. For a single parent, the greater financial burden might be harder to manage. Either way, experts recommend that families think carefully about their choices, having a conversation about emotional concerns and financial implications. Would the possible feeling of isolation from friends and colleagues, lack of work satisfaction and the trials of working at home be something the scaled-back parent could manage? What lifestyle changes would an irregular income or lower monthly earnings necessitate?

What’s the Prize?

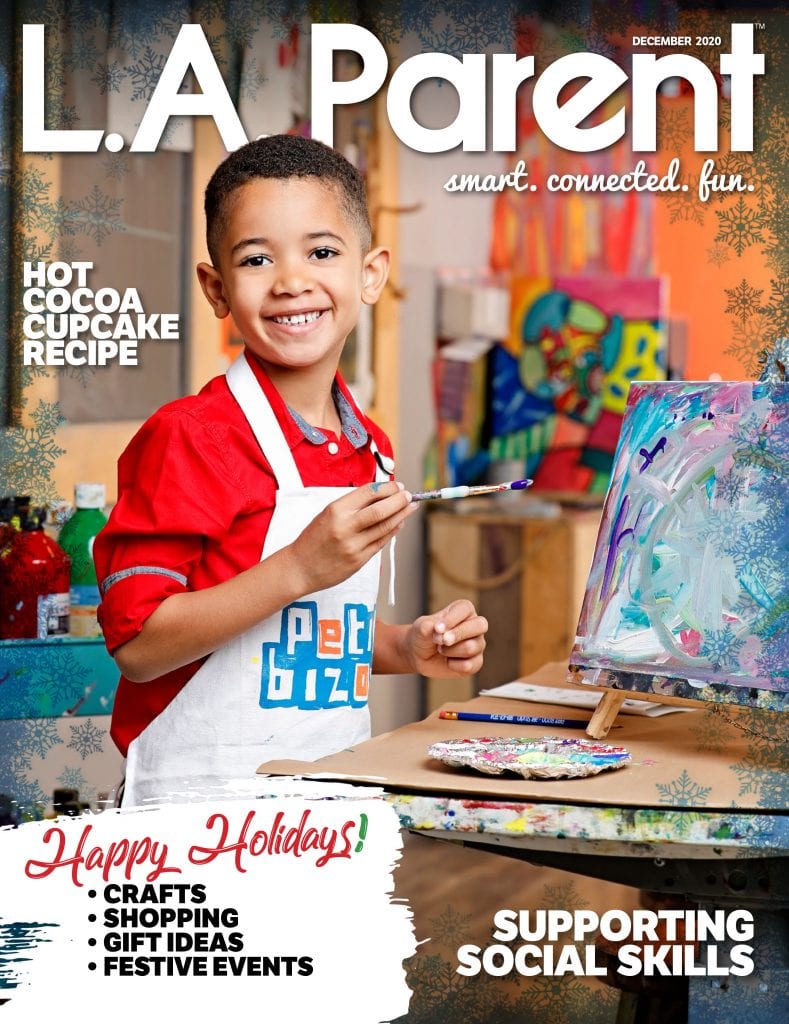

Jane Hwangbo worked on Wall Street as a hedge fund manager before making the switch to stay-at-home motherhood and founding moneyschoolwithjane.com. PHOTO COURTESY JANE HWANGBO

Being realistic is key, says Jane Hwangbo, mom of two, financial expert and the founder of moneyschoolwithjane.com. “You can’t have it all,” she says. “If it’s important to fund your kids’ college educations, help your parents through their retirement or pay off student loans, the only honest answer is that you can’t pare back, unless you have a secret stash of savings.”

Hwangbo worked on Wall Street as a hedge fund manager and had no student debt. When she stopped working to be a stay-at-home mom, she and her husband did not need to make significant lifestyle changes. “The biggest adjustments were mental and emotional,” she says. “I was used to being rewarded for my results. Suddenly, I had this little squirmy thing that wouldn’t give me a blue ribbon every time I did something right.” Hwangbo says she wasn’t ready to appreciate that her son’s smile was her reward, and that the real rewards would come years down the line.

It’s a Trade-off

Hwangbo suggests viewing the switch from full-time to part-time work as a trade-off in value of more money today versus more quality time with the kids today but warns that more time now could mean fewer financial resources later. She recommends researching the implications of decisions to create a realistic budget and healthy financial plan that meets the goals at the very top of your priority lists.

Examining the family’s needs and wants in the short, medium and long term is critical. Hwangbo’s plan includes long-range goals, agreed-upon action items, reasonable assumptions for growth and cash needs (i.e. ‘income’ and ‘expenses’) and an agreement on what you’ll do today to meet these goals. This helps families examine whether they can make the change with just a few life adjustments or whether they should maintain the status quo. “Analyze, accept, soul-search, and adjust,” she advises. “Then repeat.”

Radical Truth Telling

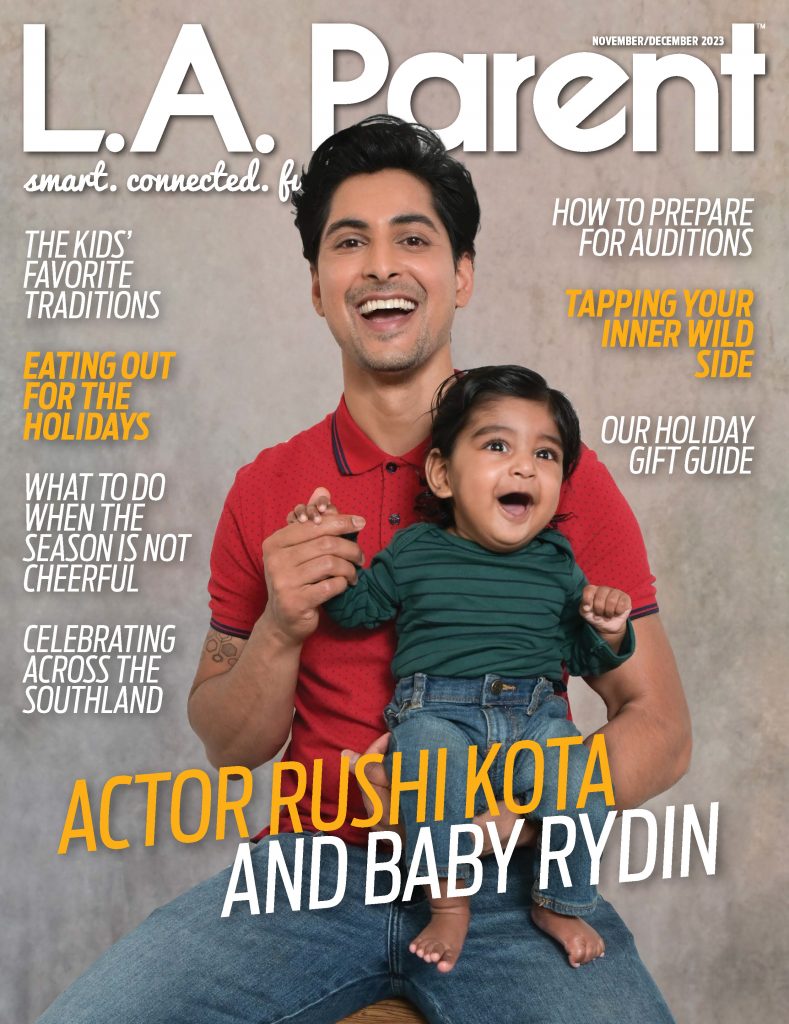

Vanessa McGrady, a freelance personal finance writer for Forbes.com, lives in Glendale with her daughter and works from home. PHOTO COURTESY VANESSA MCGRADY

Vanessa McGrady, a freelance personal finance writer for Forbes.com and other outlets, concurs. The single mom lives in Glendale with her daughter and works from home. She had a well-paying corporate job but missed writing, wanted to be able to better balance time with her child, and was feeling “increasingly at odds with the inflexibility and bureaucracy of corporate life.”

In 2014, before quitting her job, she made sure of her writing prospects, savings account and emergency fund. These are the moments for “radical truth-telling to yourself about your finances,” McGrady explains. “If you can’t pull in enough from freelance income to pay taxes (at least 35 percent of what you make should go into a separate tax account), fixed costs, savings and emergencies, then you probably can’t afford to freelance yet.” She also suggests being as debt-free as possible and paying off all your credit cards before going solo, and taking another look at your estate plan/trust to make sure it still makes sense in the context of freelancing.

McGrady and Hwangbo agree that a family must save six months of living expenses before making life changes. Then it’s time to create a budget. First, calculate your fixed costs – rent/mortgage, school fees, utilities, health and car insurance and groceries – to get a baseline of monthly expenses. According to Brittany Castro, a certified financial planner and founder and CEO of Financially Wise Women (www.financiallywisewomen.com), when you are clear on how much net income (income after taxes) is needed every month, you’ll have a better idea of what you need to do work-wise to make that amount of money every month. “Most people never get clear on [that], and continue to live paycheck to paycheck struggling to make ends meet,” she says.

McGrady points out that going freelance or cutting back hours doesn’t always mean reducing your income. “It means you need to work smarter and value what you do,” she says. Some things may even make more sense when you go freelance. In many cases, you can write off car lease payments. It also means that unless you have “anchor clients,” you will need to plan for uncertainty. And in some cases you’ll be taking on extra expense. “Figure out what job benefits you’ll have to shoulder [now],” McGrady says, “and factor those into your budget: insurance, gym memberships, dependent child reimbursement accounts, etc.”

Get Help!

Once you’ve thought things through, it’s time for the experts. “Have a good long talk with a financial professional about what you’ll need to shift,” McGrady says. Hwangbo suggests using resources such as Yelp! to locate financial planners in your area who charge by the hour (rather than as a fee on assets), instead of talking to a financial advisor at a bank or brokerage. “They’re not the brains of the bank, they’re the sales team,” she says.

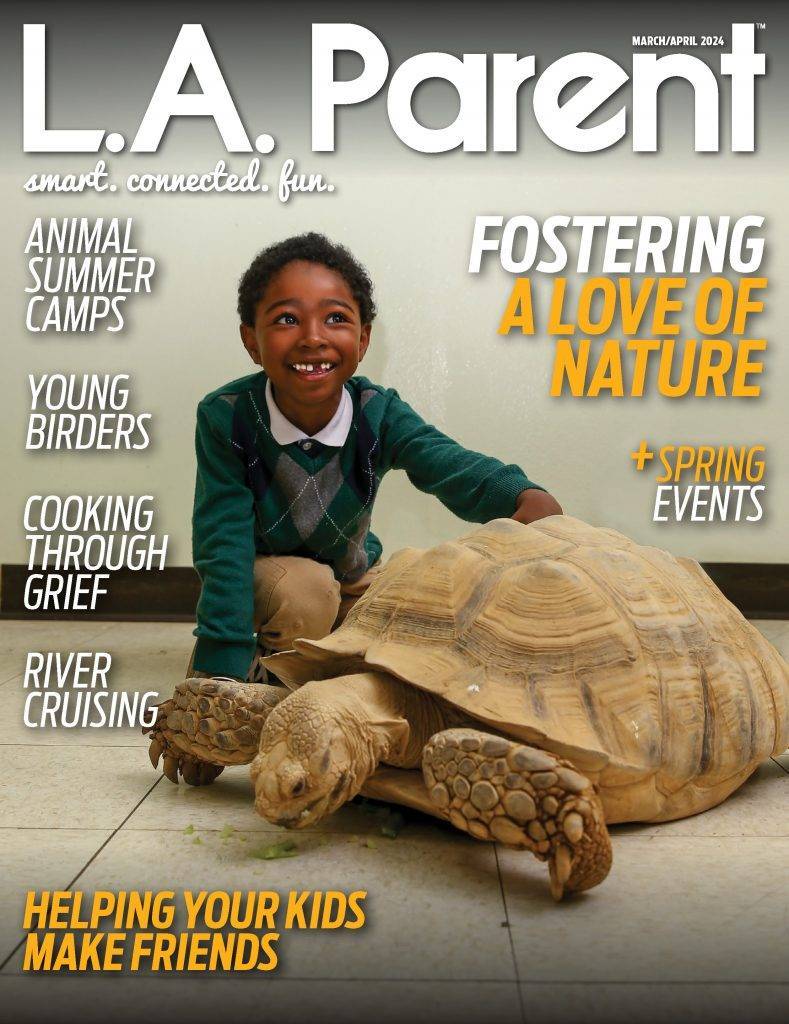

“A Certified Financial Planner can help you analyze all areas of your financial life and find the right solutions to help you use your income and assets [efficiently],” says Castro, who recommends the CFP Board website (www.letsmakeaplan.org) as a tool for finding financial planners in your area.

Castro believes goals such as kids’ college funds, retirement savings and paying off existing student loans are reachable, but parents should remember to prepare for retirement before saving for their children’s education. “You can always help your kids out,” Castro explains, “but you cannot take a loan out for your retirement. It is a better gift to give your kids [that] they won’t have to support you financially.”

Make the Change Creatively

Brittany Castro, a certified financial planner and founder and CEO of Financially Wise Women, says it is important to be clear on how much net income you need every month. PHOTO COURTESY BRITTANY CASTRO

McGrady started a 529 college savings plan for her daughter that family members (Grandma, Grandpa, etc.) can also contribute to, and a Health Savings Account. “You can set [it] up through your bank,” she says. “It’s like saving 35 percent on your health dollars.”

She says scaling back also means opening one’s eyes to unnecessary expenses. “There’s hidden money out there for nearly everything, you just have to find it,” she insists. How about bartering? “Can you do the newsletter for the gymnastics studio in exchange for lessons? Are there scholarships to private schools you haven’t explored? Are you wasting money on subscriptions or memberships you are not using?” asks McGrady.

Hwangbo also advises finding ways to cut dollars in your monthly family budget. “This can come through more frugal shopping, fewer fancy vacations – whatever you can let go for the bigger goals of your family,” she says.

Extend this budget cutting to your kids. “As parents, we want our children to have everything,” Hwangbo admits, “but our kids don’t really want everything.” Teaching them the ways of finance at an early age is one of the greatest kindnesses you can do them. Kids can learn to spend less at the mall and wait longer for luxuries like new phones or laptops. “When my teen daughter gets a cash gift, I ask whether she’d like me to deposit it in the bank,” says Hwangbo. “If she chooses to purchase something instead, we talk about trade offs so she understands her decision and feels responsible.”

Castro says that’s the way to go. “Include your kids in budget discussions,” she urges. “By teaching [them] the importance of smart money management habits, you are setting them up for a more successful financial future.”

And in the midst of all the planning and juggling, Hwangbo suggests also taking a moment to reflect on how many treasured experiences in your life had nothing to do with money. “We create our memories through love,” she says.

Kaumudi Marathé is a journalist and chef, but her favorite job is being the mom of her 14-year-old. When she isn’t driving to and from ballet class, volunteering at school events or walking her puppy, Kaumudi teaches cooking, writes freelance and runs long distances in Glendale.